It wasn’t supposed to be this way. When Donald Trump threw a tariff-shaped grenade into the global economy, the expectation was chaos – supply chain meltdowns, retaliatory trade wars, and higher prices slapped across every Walmart aisle. The mission was economic nationalism, not environmentalism. Yet somewhere between the shouting matches and WTO lawsuits, something unexpected happened: companies started looking closer to home. It’s almost as if by a complete accident, companies are being forced to relook and embrace local materials to keep costs down.

We’ve spent decades perfecting a system where raw materials, components, and finished goods crisscross the planet like hyperactive hummingbirds chasing the cheapest possible production cost. That t-shirt might involve cotton from India, spun in Vietnam, sewn in Bangladesh, and printed in Mexico before landing in your drawer. Each leg of that journey burns fuel, spewing carbon. The global shipping industry alone has a carbon footprint larger than Germany’s. We built this incredibly efficient system for cost, turning a blind eye to the environmental bill stacking up offshore.

Our Global Carbon Addiction

We’ve become masters of planetary hopscotch manufacturing. Raw materials are extracted on one continent, processed on another, assembled on a third, and shipped worldwide. This intricate global supply chain, optimized relentlessly for low labor costs and cheap materials, has an enormous hidden environmental price tag. Think of the millions of barrels of bunker fuel burned by container ships annually – the shipping industry alone accounts for roughly 3% of global CO2 emissions.

This system wasn’t built with malice, but with spreadsheets. The logic was simple: if it’s cheaper to make it halfway around the world, do it. The environmental cost – the CO2 emissions, the resource depletion, the waste generated thousands of miles away – was conveniently externalized, kept off the balance sheets. We embraced the affordability of global goods without fully reckoning with their true carbon weight, embedding long-distance transport into the DNA of modern commerce.

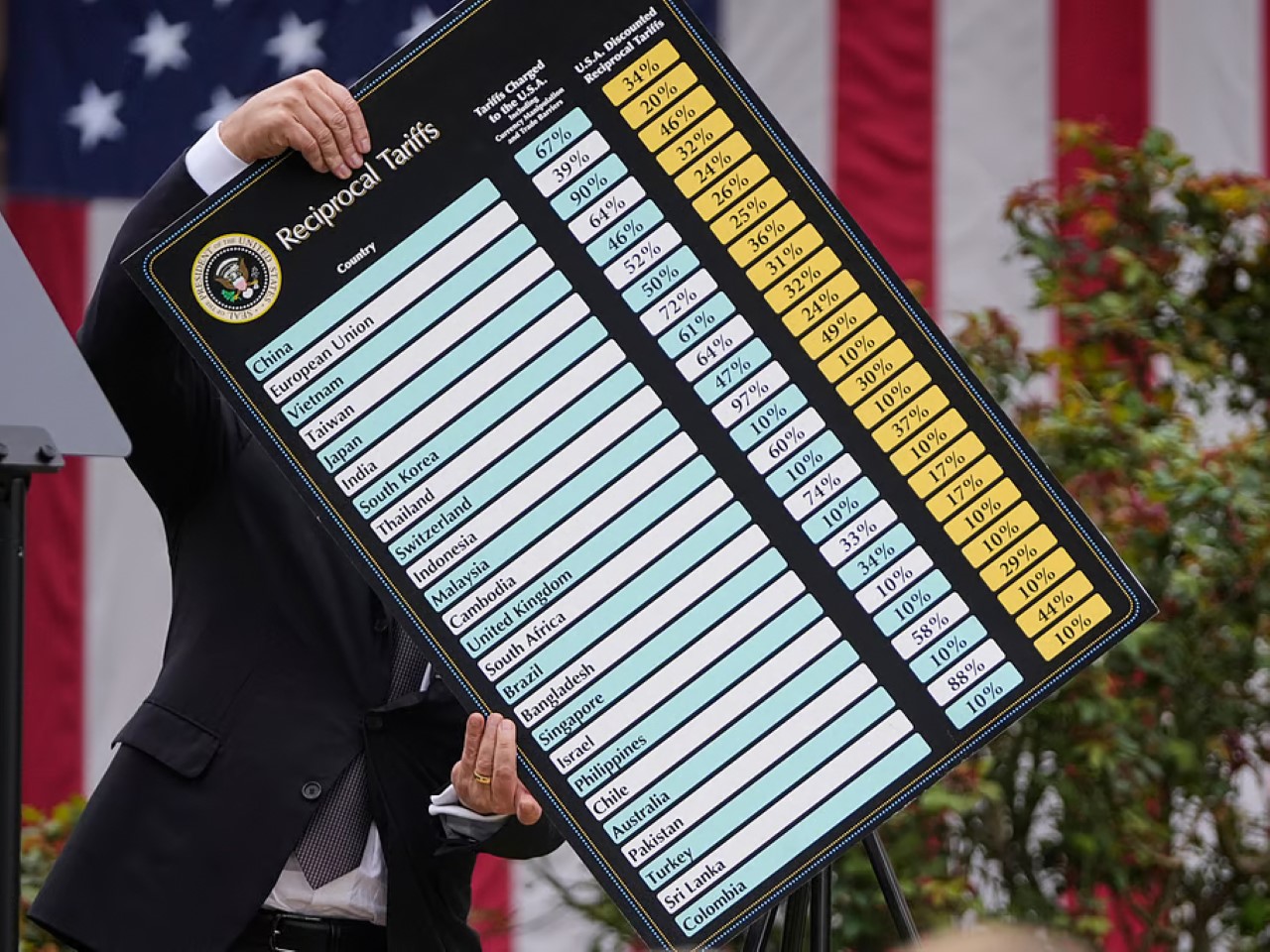

The Tariff Shock Therapy

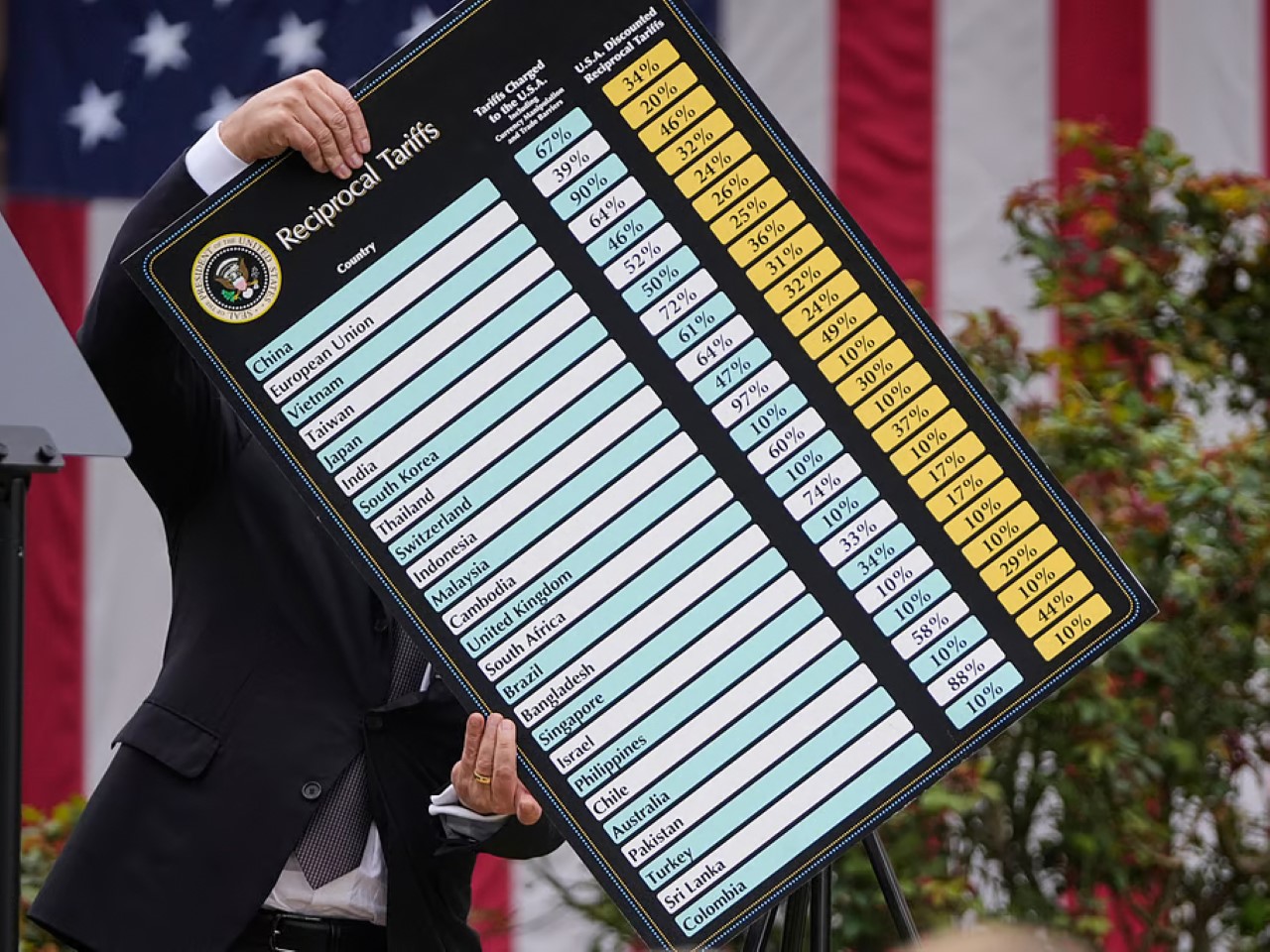

Enter the tariff threats, acting like an economic electroshock paddle. Suddenly, the cost calculations that underpinned global supply chains are thrown into disarray. That product manufactured overseas might face crippling import taxes, erasing its cost advantage overnight. This isn’t a gentle nudge towards sustainability; it’s a potential financial body blow forcing companies to fundamentally rethink where and how they make things, purely for self-preservation.

The immediate reaction is often panic, followed by a desperate search for alternatives. Companies that previously wouldn’t dream of paying higher domestic production costs are now crunching the numbers differently. When faced with massive tariffs, sourcing locally shifts from a niche consideration to a potential lifeline. Proximity, once sacrificed for price, suddenly re-emerges as a critical factor in managing risk and maintaining competitiveness in a newly hostile trade environment.

Denim’s Unlikely Homecoming

No industry tells the globalization story better than textiles. Once a staple of American manufacturing towns, denim production largely packed up and moved overseas by the 1990s. Brands obsessed over Japanese mills like Kurabo in Kojima, citing artisanal quality, while ignoring the planetary costs of shipping heavy cotton halfway across the world.

Tariffs are changing that calculus fast. With 60% duties looming, brands are racing to resurrect relationships with mills like Vidalia in Louisiana and Mount Vernon in Georgia. And it’s not just flag-waving nostalgia. Domestic production slashes transportation emissions by roughly 80%. Water use drops, too – American mills like Cone Denim have invested heavily in closed-loop recycling systems that save millions of gallons annually compared to typical Asian mills.

From a carbon standpoint, American-made jeans can shrink a product’s footprint by up to 40%. Most consumers can’t tell the tactile difference between Japanese and American selvedge – but they’d notice if they could read the emissions receipts. In a twist nobody saw coming, tariffs are making it easier – and cheaper – to do the right thing.

Building Better: Architecture’s Local Materials Movement

For decades, imported materials were the architectural flex. Italian marble, Brazilian hardwoods, German-engineered fixtures – each item carried both a luxury aura and a hefty carbon tag. Just moving a ton of marble across the Atlantic pumps out more than double the emissions of sourcing Vermont stone. And those exotic woods? Often logged under sketchy conditions that would fail even the weakest American environmental audits.

Now that tariffs are inflating the cost of foreign finishes, American alternatives are having a quiet renaissance. Builders are swapping European oak and Canadian timber for Appalachian varieties with comparable hardness and beauty. Vermont marble quarries are buzzing again as architects realize it’s nearly indistinguishable from Carrara but without the ocean-crossing guilt.

The image above is of designer & professor Stefano Santilli presenting Work in Process at Collect 2019, Saatchi Gallery (Feb 28 – Mar 3), in collaboration with the American Hardwood Export Council. Using American red oak, cherry, and maple, Santilli explored creation as an ongoing evolution, transforming found objects into sculptural vessels through 3D scanning, steaming & folding.

Rethinking Everyday Goods: From Plastic Toys to Wooden Blocks

Even the toy industry, dominated by plastic manufacturing in Asia, feels the tremor. If tariffs make those ubiquitous plastic imports significantly more expensive, suddenly alternatives like American-made wooden toys shift from premium novelties to viable competitors. This represents a move away from fossil-fuel-derived, landfill-bound products towards renewable, often biodegradable materials sourced closer to home, embodying a more sustainable approach to design and consumption.

This principle extends far beyond toys. Furniture, housewares, electronics components – across the board, the added cost of tariffs forces a re-evaluation of material choices and manufacturing locations. It challenges the assumption that foreign always means cheaper or better, pushing designers and brands to rediscover the potential of local resources and craftsmanship. It’s a market correction driven by policy (or a presidential whim, whatever you want to call it), nudging product development towards potentially more durable and earth-friendly solutions.

An Accidental Boost for Recycling

Tariffs also inadvertently bolster the case for recycling. A major hurdle for recycling programs has been economic: virgin materials, especially plastics shipped cheaply from overseas, often cost less than collecting, sorting, and reprocessing domestic waste. This created a disincentive to invest in robust circular economy infrastructure, leading to overflowing landfills and wasted resources.

But when tariffs increase the cost of those virgin imports, the equation changes. Suddenly, our own streams of discarded plastic, paper, metal, and glass become more economically attractive feedstocks. Manufacturers have a stronger financial reason to utilize recycled content, driving demand for recovered materials and potentially spurring investment in the domestic recycling systems needed to supply them. It’s a backdoor boost to a circular economy, prompted by a VERY absurd outright executive order.

Not So Fast: The Downsides and Hurdles

Let’s be clear-eyed: this is hardly a perfect path to sustainability. Decades of offshoring have decimated US manufacturing capacity in many sectors; rebuilding it requires enormous investment, time, and training workers with the right skills. Many specialized materials or components simply aren’t available domestically at the scale needed, creating unavoidable dependencies or forcing costly substitutions.

Furthermore, consumers will likely bear the brunt through higher prices, potentially leading to inflation and economic hardship. There’s also the risk that companies, under pressure to reshore quickly, might compromise on environmental standards at home, simply relocating pollution rather than reducing it. And if these tariffs prove temporary, the incentive to localize might evaporate, leaving investments stranded.

Resilience: The Unexpected Silver Lining

Despite the considerable economic risks and challenges, perhaps the most significant long-term benefit lies in resilience. The pandemic starkly illustrated the fragility of long, lean, globally optimized supply chains. A single disruption could cascade through the system, halting production worldwide. Tariffs, in their own disruptive way, force companies to confront this vulnerability again.

Building shorter, more diversified, and geographically closer supply networks isn’t just about managing tariff costs; it’s about building robustness against future shocks, whether they be pandemics, geopolitical flare-ups, or climate-related disasters. This tariff-induced scramble might inadvertently push companies towards models that are not only lower-carbon but also fundamentally more stable and adaptable in an increasingly uncertain world. That enhanced resilience could be the most valuable lesson learned. That is, if we’re prepared to learn it…